What is a Rent Roll?

A rent roll is a document for property managers that acts as a snapshot of the current income of a property.

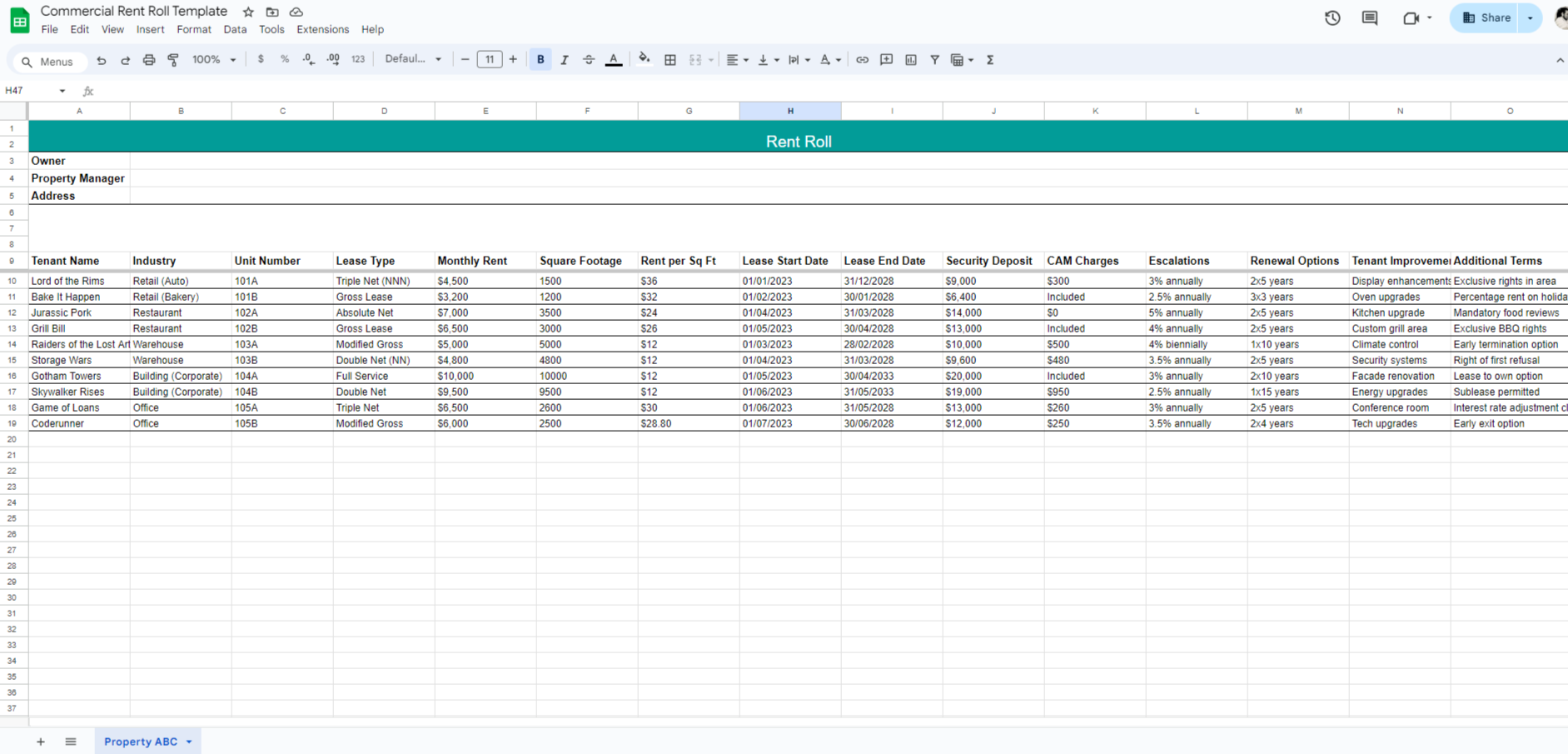

Think of it as an operational income report, a rent roll lists all tenants, their leased spaces, the duration of their leases, and the rent they pay, which provides property managers and owners with a quick overview of the property’s financial health. Don’t worry, we have a rent roll example spreadsheet for you below.

Rent Roll vs. Lease Ledger: Unlike a lease ledger, which records all financial transactions related to lease payments, a rent roll focuses more on the static aspects of the tenancy agreements at any given point in time.

Imagine you own a small shopping center. When you look at your rent roll, you see that a popular boutique has two years left on its lease at $2,500 per/mo, whereas a new cafe has just signed a five-year lease at $3,000 per month. This immediate insight allows you to strategize effectively, and even decide when to negotiate lease renewals.

Is a Rent Roll Helpful for a Property Manager?

At worst, it’s something a property manager has to update regularly. At best, it’s a very important document that can guide many financial and tenant-relationship factors of the property.

The benefits of maintaining a detailed rent roll are plentiful.

- A comprehensive rent roll enables you to track rental income and anticipate cash flows, crucial for CRE budget planning and financial stability.

- It can serve as a tool for risk management by highlighting lease expirations and vacancies, allowing you to mitigate potential income gaps before they occur.

For example, consider a property manager looking after multiple residential buildings. The property manager not only keeps on top of current tenants and their payment statuses but also uses this information to report to investors and financial entities, always highlighting the property’s profitability and stability. Data like this is also key to refinancing or selling the property, as it provides potential buyers or lenders with a transparent picture of the property’s value.

The true rent roll utility is seen when property managers use it to improve tenant relations and retention strategies. Knowing the lease terms and conditions allows managers to proactively engage tenants about renewal options or address their needs more effectively, enhancing tenant satisfaction and ultimately, retention rates. All of which make the financial significance of rent rolls big, to say the least.

- Proactive lease management

- Financial planning

- Efficient marketing

- Optimized rent adjustments

- Better dispute resolution

- Data-driven renovations

If you make your own rent roll, you’ll start with basic columns for tenant names, unit numbers, lease start and end dates, and monthly rents. As you become more familiar with its benefits, you might expand this rent roll example to include more detailed information. Payment histories, security deposit amounts, and notes on tenant interactions would likely be something you add based on your situation. And if you want to get really fancy, I’d suggest using formulas to auto-populate other connected sheets based on the main data in the rent roll itself.

Your Rent Roll Template

Creating a rent roll from scratch may seem like a chore, but it’s a must for effective property management. Start by collecting all lease agreements and tenant details.

As mentioned, your rent roll should include basic information such as tenant names, unit numbers, lease start and end dates, monthly rents, and total lease value on its most basic level. You can create a rent roll template using Excel or Google Sheets (like I have below), which allows for easy updates and calculations. Some people may even prefer their rent roll to be in an editable PDF, whatever works for you. I’ve also included various types of businesses and industries so you can see how they might differ from each other.

To get started on creating your rent roll: set up columns for all the components of your rent roll and ensure each tenant’s information is consistently entered. You can see below that mine is more involved, but basic information is fine to get started with. You can always add more columns later as you see fit. For now though, here are the columns in my example below:

- Tenant Name

- Industry

- Unit Number

- Lease Type

- Monthly Rent

- Square Footage

- Rent per Sq Ft

- Lease Start Date

- Lease End Date

- Security Deposit

- CAM Charges

- Escalations

- Renewal Options

- Tenant Improvements

- Additional Terms

Here’s what a rent roll looks like:

Practical Examples and Application

If we look at a rent roll in real-world scenarios, open the rent roll template linked above. You’ll see businesses such as “Lord of the Rims,” a retail auto parts store, and “Grill Bill,” a restaurant, both located in the same commercial property.

Suppose the property manager notices from the rent roll that “Bake It Happen” has negotiated a lease that includes a clause for percentage rent on holidays. This information indicates higher anticipated revenues during holiday seasons, which are crucial for financial planning. In contrast, “Lord of the Rims” pays a fixed rent but has exclusive rights to automotive parts sales in the area, securing steady income and eliminating competition within the property.

One month, the rent roll reveals that “Bake It Happen” has exceeded its revenue threshold earlier than expected, triggering the percentage rent clause. This prompts the property manager to arrange a meeting with the restaurant’s owner to discuss the increased payment due and explore opportunities for further business support during peak seasons. This proactive management ensures the financial terms are adhered to and strengthens the relationship with the tenant by aligning the property management’s interests with the success of the tenant’s business.

In that hypothetical, the rent roll acts as more than just a financial record; it is a strategic tool that helps the property manager support tenant success, adjust management strategies based on real performance data, and enhance overall property profitability.

Expanding and Optimizing Your Rent Roll

Optimizing your rent roll involves more than just keeping it updated—it’s about leveraging the full potential of the spreadsheet so that the property is in proper financial working order. This can translate to profitability in many way: higher retention rates, updated buildings, better tenants, and on and on.

Looked at through that lens, it’s easy to see how integrating things like payment histories, service requests, and lease renewal probabilities are worthwhile. This type of expanded rent roll not only provides a comprehensive view of each tenant’s status, as well as helping to predict future trends and tenant behaviors.

Accuracy and Verification

It should be obvious that this is one of those “your decisions are only as good as the data” situations. Ensuring accuracy involves regular audits and cross-referencing rent roll entries with independent sources such as bank statements, lease agreements, and tenant communications. Regular updates and checks prevent discrepancies that could lead to financial mismanagement or conflicts with tenants.

For example, a monthly review might reveal that the rent amount entered for a new tenant in “Skywalker Rises” does not match the lease document. Immediate correction and verification with the tenant can prevent future complications, such as incorrect billing or legal disputes. Additionally, adopting digital tools that automatically update and flag inconsistencies can help maintain the accuracy of rent rolls. Tools like AppFolio and Buildium are good examples of this.

FAQs and Insights

In this section, we address some frequently asked questions about rent rolls to clarify common uncertainties and provide strategic insights. For example:

- How do residential and commercial rent rolls differ? Residential rent rolls typically track less complex leases and might focus more on individual lease durations and rent amounts, while commercial rent rolls often include details like CAM charges, renewal options, and specific lease types due to their complex nature.

- Do tenants need to create a rent roll? The simple answer is no, tenants don’t need to create a rent roll. However, large commercial tenants might track their lease obligations across multiple locations using a similar document (think: regional franchise operation with several locations).

- Should you buy a rent roll? Buying a property with an existing rent roll can provide valuable insights into its financial performance and tenant stability, which is crucial for investment analysis.

- How can rent rolls be used to forecast property maintenance needs? Rent rolls can help property managers predict maintenance needs by tracking lease durations and tenant longevity, allowing for planned maintenance and minimizing unexpected repairs. For example, you could add conditional formatting into your rent roll spreadsheet that adds a notation like “carpet needs to be replaced” for every lease that is over 5 years.

- What legal considerations are there when sharing rent roll information with third parties? Sharing rent roll information must comply with privacy laws, and usually requires confidentiality agreements to protect tenant data and ensure legal compliance.

- Can rent rolls influence property insurance policies? Yes, details in rent rolls (i.e., tenant types, lease stability, etc) can impact property insurance assessments, which affect premiums and coverage terms based on perceived risk.

Implementing Your Rent Roll Template

Start by gradually integrating the rent roll with your other management tools. Regular training for your management team on how to update and analyze the rent roll effectively can enhance its usefulness. I’d also suggest setting up periodic reviews to discuss insights from the rent roll and adjust management strategies accordingly.