Understanding financial responsibilities in real estate is high on the list of anyone’s list, whether they’re an investor, lender, or property manager. One of the key instruments in defining the hierarchy of these responsibilities is the subordination agreement. These agreements play a big role in structuring the priorities of different creditors, especially when multiple stakeholders with competing interests are involved. Fortunately for you, we have a template ready to help make this process a little easier!

Subordination agreements…the 101 version

At its core, subordination is a legal agreement that adjusts the priority of claims. This typically involves agreements between senior and junior lenders. A subordination agreement is used to dictate that certain lenders’ claims will be paid back only after other lenders or claims have been settled. This is particularly relevant in situations involving refinancing or selling properties under a mortgage.

For example, if a property owner wants to obtain a second mortgage, the second lender will usually require a subordination agreement from the first lender. This ensures that the second lender’s interests are protected in the event of a default, where the first lender’s claim will take precedence in debt recovery.

Parties That Are Usually Included

The typical parties involved in a subordination agreement include:

- The Borrower: The property owner who is seeking or has existing mortgages and wants to rearrange the priority of these debts.

- The Senior Lender: The creditor with the primary claim, whose debt is prioritized over others in the agreement.

- The Junior Lender: The creditor whose claim has been agreed to be subordinate to the senior lender’s claim.

In CRE, these agreements ensure that primary lenders maintain their seniority in claims against the borrower’s assets, thereby reducing their risk and encouraging them to lend more favorable terms or larger amounts. This arrangement not only clarifies the financial hierarchy but also stabilizes the borrowing environment by clearly delineating creditor standings.

Key Terms in Subordination Agreements

To work through this type of agreement effectively, we’re including a table of key terms with their definitions and examples tailored for commercial real estate scenarios. Hopefully this helps you understand the rest of the post, as well as the template itself. Feel free to refer back to this table whenever you need to!

| Term | Definition | Example |

|---|---|---|

| Subordination | An agreement where one party’s claim or interest is made subordinate to another’s. | A second mortgage lender agrees their loan repayment will be prioritized after the first mortgage is cleared. |

| Non-Disturbance | Assures tenants that their lease will be honored, even if the property is sold or foreclosed. | A tenant in a commercial building will retain their lease terms and rights despite a change in building ownership. |

| Attornment | A tenant’s acknowledgment to continue their tenancy under a new landlord following a property sale. | Following the sale of an office building, the existing tenants agree to recognize the new owner as their landlord. |

| Right of Quiet Enjoyment | The tenant’s right to use the property without interference from the landlord or other parties. | A commercial tenant operates without disturbances from the property owner or other claimed parties. |

SNDA: 3 Agreements in One

The SNDA, or Subordination, Non-Disturbance, and Attornment agreement, is integral in commercial real estate, combining three pivotal legal concepts into one document. This amalgamation ensures that all parties’ interests are balanced and protected, facilitating smoother transitions and clearer responsibilities in property transactions.

- Subordination: This part of the agreement specifies that if the property is sold, the new owner’s mortgage will take precedence over existing leases. This clause is crucial for lenders, as it guarantees their loan’s priority over earlier claims or leases.

- Non-Disturbance: This component reassures tenants that their leases will remain in force even if the property is sold or foreclosed (especially helpful now since so many office buildings are empty!). It’s a key element for tenants, as it secures their right to occupy the property under agreed terms, regardless of changes in property ownership or valuation.

- Attornment: This term requires tenants to recognize the new property owner as their legitimate landlord after a sale or transfer. Attornment is essential to ensure that leases are honored by both tenants and the new owner, thus maintaining lease continuity and stability.

Additionally, the Right of Quiet Enjoyment is embedded within these clauses, affirming that tenants can use their leased spaces without interference. This right is vital for tenants as it ensures operational stability and safeguards against potential disruptions from property ownership disputes or changes.

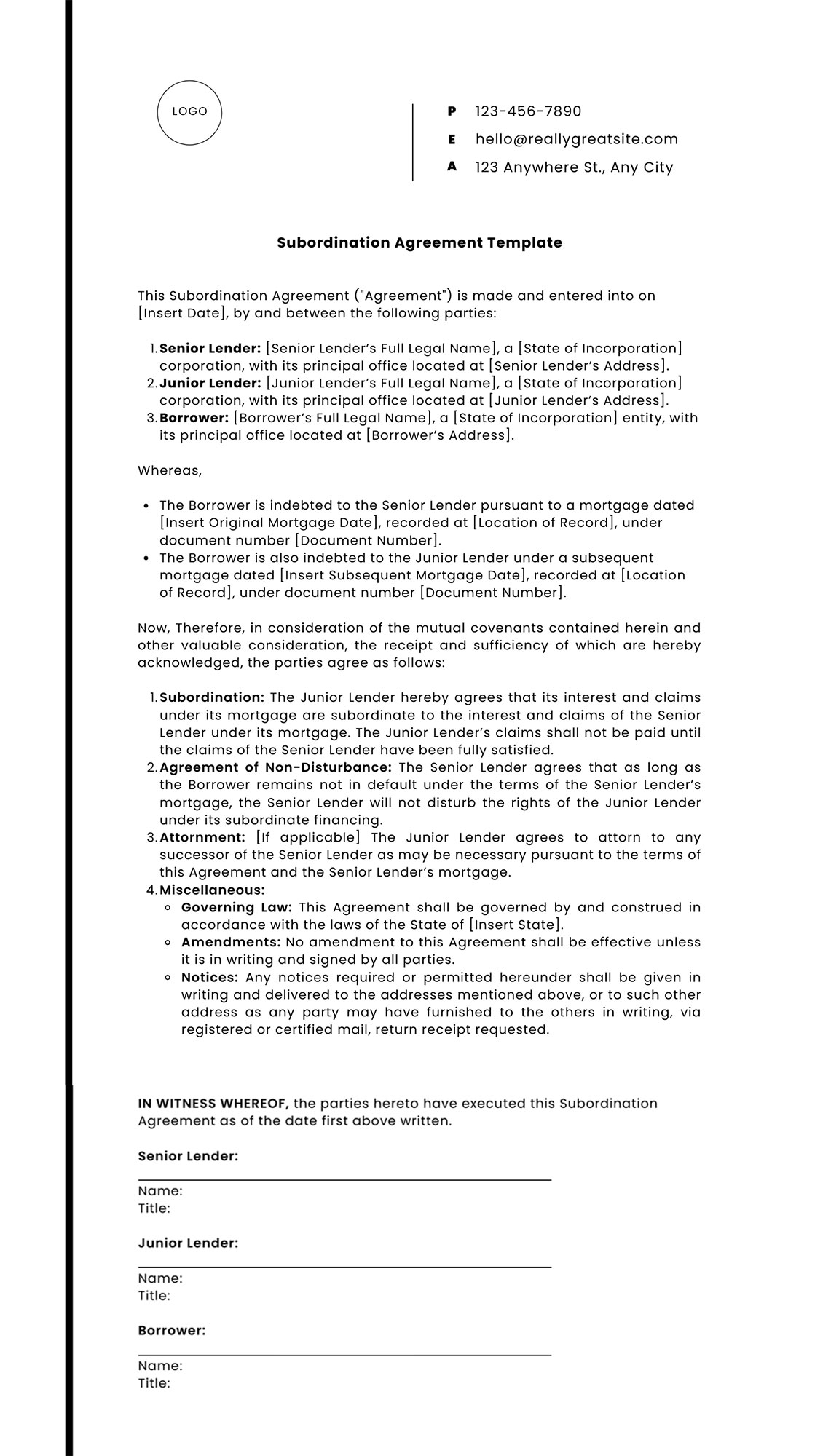

The Subordination Agreement Template

Below is a simplified version of such a template, designed to be adapted as necessary to fit specific situations and legal requirements. Remember to replace placeholders with specific details relevant to your transaction and consult with a legal professional to ensure compliance and appropriateness.

Tailoring Your Subordination Agreement

The provided template is a robust starting point, but it’s important to remember that you may want to tailor your agreement to your specific situation. This could include adding or removing certain pieces, or making sure that your subordination agreement fits the specific and legal frameworks relevant to your situation or locale. Here are some tips for adapting the template:

- Consult with Legal Professionals: Before finalizing any subordination agreement, consult with a lawyer who specializes in commercial real estate and financial law in your state. They can provide critical insights and modifications that align with local laws and the specific nuances of your situation.

- Address Specific Needs: Depending on the nature of the transaction and the involved properties, additional clauses might be necessary. For example, if there are specific concerns about the property’s use or the borrower’s financial stability, these should be addressed directly in the agreement.

- Review Regularly: As laws and economic conditions change, periodically review and update your subordination agreements to ensure they remain effective and enforceable.

Conclusion

Subordination agreements help clarify the financial landscape for lenders, protect tenants, and maintain property value by ensuring the stability of investment and lease agreements.

We hope this guide has provided you with valuable insights into crafting and customizing subordination agreements for your commercial real estate needs. Remember, a proactive approach to understanding and managing these agreements can significantly impact the success of your financial dealings in the real estate sector.